We are uniquely qualified to help Lockheed Martin Team Members with the management of their Empower plan. Using our extensive financial background and personal knowledge of Lockheed Martin’s retirement plan, we help people like you “Add Some Rocket Fuel to Their 401(k).”

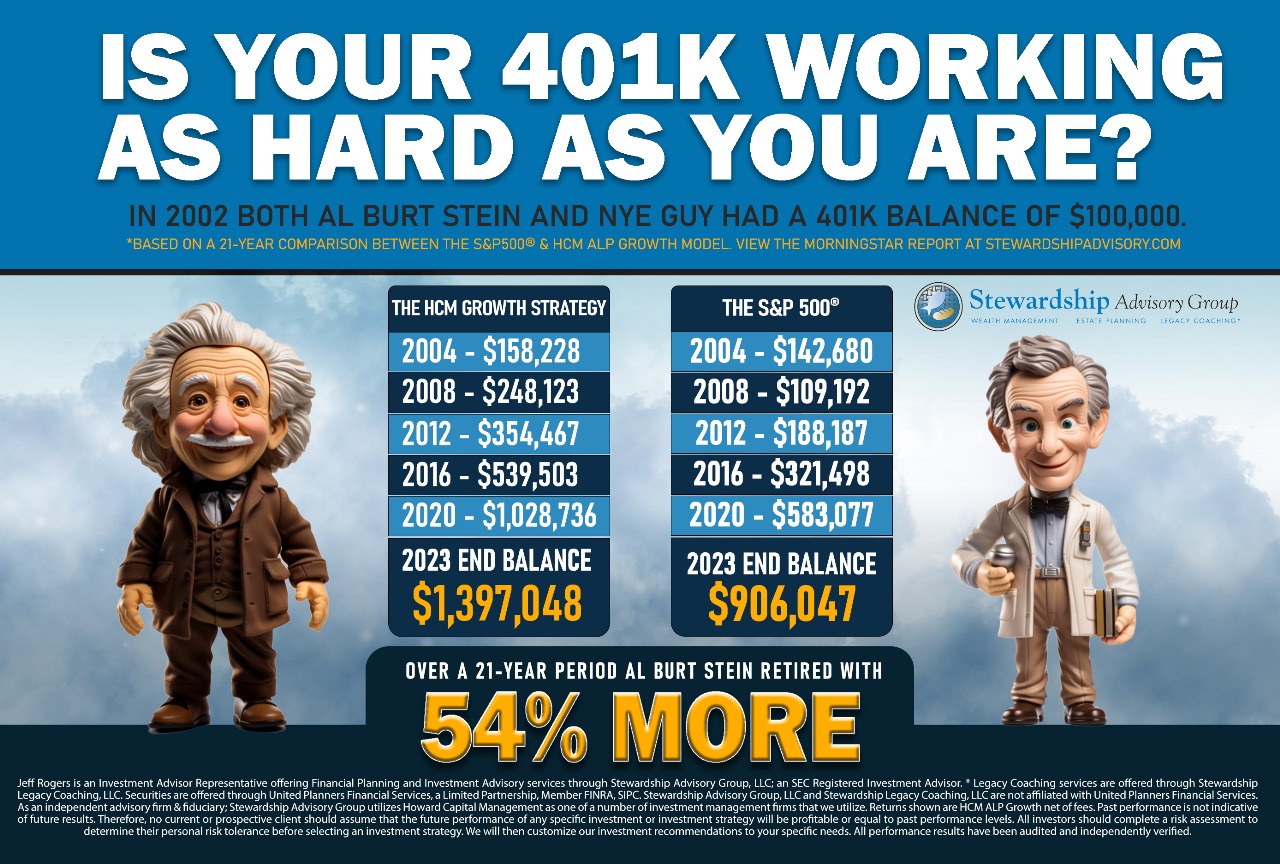

We use a proprietary quantitative investment indicator to help determine when we should be in or out of the market. This non-emotional, mechanical, and repeatable system helps take the emotion and the guesswork out of investment decisions. We can help you fortify your investment strategies against volatility to ensure your retirement plan is working as hard as you are so you can focus on what really matters to you.

WE MAKE SURE YOUR 401K IS WORKING JUST AS HARD AS YOU ARE!

Order Your FREE Retirement Toolkit Now!

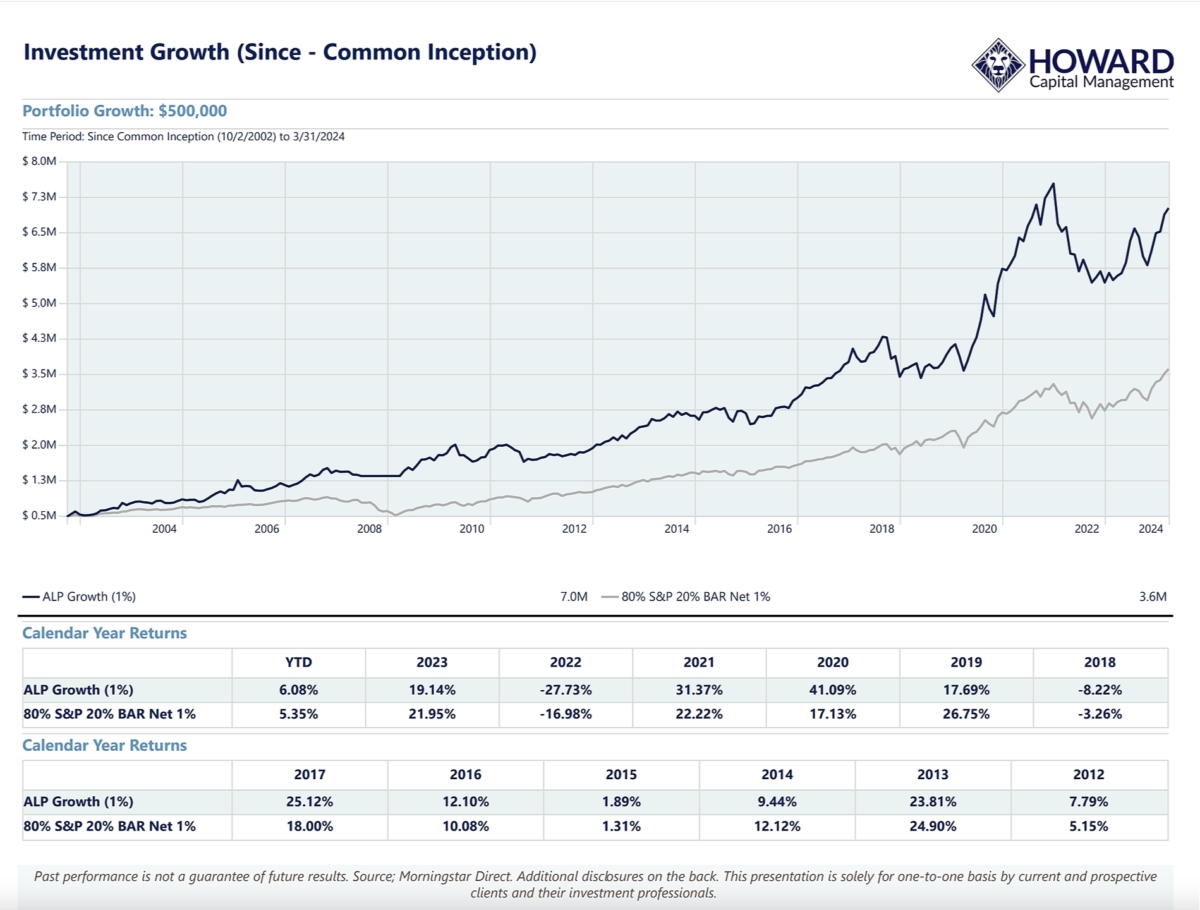

Active Lifestyle Portfolio Model Overview Disclosure

Active Lifestyle Portfolio (ALP) strategy typically seeks to participate in all markets and sectors by investing the portfolio in sectors which HCM’s Proactive Section Rotation (PSR) methodology indicates have potential to meet performance objectives. PSR is a tactical asset allocation methodology, which attempts to identify the best performing sectors at a given point in time. The ALP strategy utilizes the HCM-BuyLine® proprietary indicator to monitor market conditions and assist in determining whether or not assets should be invested in equity products or moved to cash, cash equivalents, or bond funds. Multiple indicators are monitored in an effort to identify such trends in the equity markets. The strategy is rebalanced periodically, and it is possible for the allocation to be adjusted, including when the HCM-BuyLine® indicates a strengthening or weakening of the equity markets. Because this Howard Capital Management, Inc. (HCM) strategy is actively managed, it may experience above-average turnover, which could have a negative impact on account performance. To discourage short-term investing and excessive trading, mutual funds, including those utilized in the ALP strategy, may impose short-term redemption fees that range from 0.50% to 2.00%. HCM seeks to avoid these fees, but they may occasionally be incurred.

Comparative Benchmark. Aggressive – S&P 500 Monthly Reinvested Index (10%), HFRX Equity Hedge Index (90%). Growth- S&P 500 Monthly Reinvested Index (5%), HFRX Equity Hedge Index (75%), Barclays Capital US Aggregate Bond TR Index (20%). Balanced- S&P 500 Monthly Reinvested Index (5%), HFRX Equity Hedge Index (60%), Barclays Capital US Aggregate Bond TR Index (35%). Conservative- S&P 500 Monthly Reinvested Index (5%), HFRX Equity Hedge Index (40%), Barclays Capital US Aggregate Bond TR Index (55%). S&P 500 Reinvested is a gauge of the large cap U.S. equities market. The index includes 500 leading companies in leading industries of the U.S. economy, capturing 75% coverage of U.S. equities. S&P 500 Reinvested assumes dividends are reinvested. Visit http://www.standardandpoors.com/indices for more information regarding Standard & Poor’s indices.

HFRX Equity Hedge Index is constructed using a UCITSIII compliant methodology, which is based on defined and predetermined rules and objective criteria to select and rebalance components to maximize representation of the Hedge Fund Universe. HFRX Indices utilize quantitative techniques and analysis, multi-level screening, cluster analysis, Monte-Carlo simulations and optimization techniques to ensure that each Index is a pure representation of its corresponding investment focus. Full strategy and regional descriptions (multi-language), as well as the full “HFRX Hedge Fund Indices Defined Formulaic Methodology” may be downloaded at www.hfrx.com. Barclays Capital US Aggregate Bond TR Index is a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS.

The US Aggregate rolls up into other Barclays Capital flagship indices such as the multi-currency Global Aggregate Index and the US Universal Index, which includes high yield and emerging markets debt. The US Aggregate Index was created in 1986, with index history backfilled to January 1, 1976. Total Return (TR) assumes yield is reinvested. Visit https://ecommerce.barcap.com/indices for more information regarding Barclays Capital indices. Indices are unmanaged investment measures and are not

available for investment purposes.

Active Lifestyle Portfolio (ALP) strategy data in this report has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of Howard Capital Management, Inc. Howard Capital Management, Inc.

(“HCM”) is an SEC-registered investment advisor with its principal place of business in the State of Georgia. SEC registration does not constitute an endorsement of HCM by the SEC, nor does it indicate that HCM has arraigned a particular level of skill or ability. HCM only transacts business where it is properly registered or is otherwise exempt from registration. This presentation is limited to the dissemination of general information pertaining to its investment advisory/management services. Any subsequent, direct communication by HCM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of HCM, please contact HCM or refer to the Investment Advisor Public Disclosure web site (www.adviserinfo.sec.gov). For additional information about HCM, including fees and services, send for our disclosure statement as set forth on Form ADV from us using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely.

All investment approaches have the potential for loss as well as gain. There is no certainty that any investment or strategy (including the investments and/or investment strategies recommended by the advisor), will be profitable or successful in achieving investment objectives. Please work with your financial professional to determine which investment program is consistent with your financial objectives and risk tolerance.LASS.ALPO.MS.0920

Source: Morningstar

Your retirement account is likely one of your largest assets.

Are you allowing it to adapt for optimum results?

For most in the Defense Sector, the answer is absolutely not. Smart investment decisions within your retirement account are mission critical since the funds you accumulate over the coming years may need to support you through many years of retirement.

We Can Help You Complete

Your Retirement Mission

LOCKHEED MARTIN HAS ENHANCED YOUR EMPLOYER-SPONSORED QUALIFIED RETIREMENT PLAN TO INCLUDE ACCESS TO PROFESSIONAL MONEY MANAGEMENT THROUGH A SELF-DIRECTED BROKERAGE ACCOUNT OPTION. THIS PROVIDES YOU ACCESS TO THOUSANDS OF OTHER INVESTMENT MODEL OPTIONS FOR YOUR RETIREMENT ACCOUNTS.

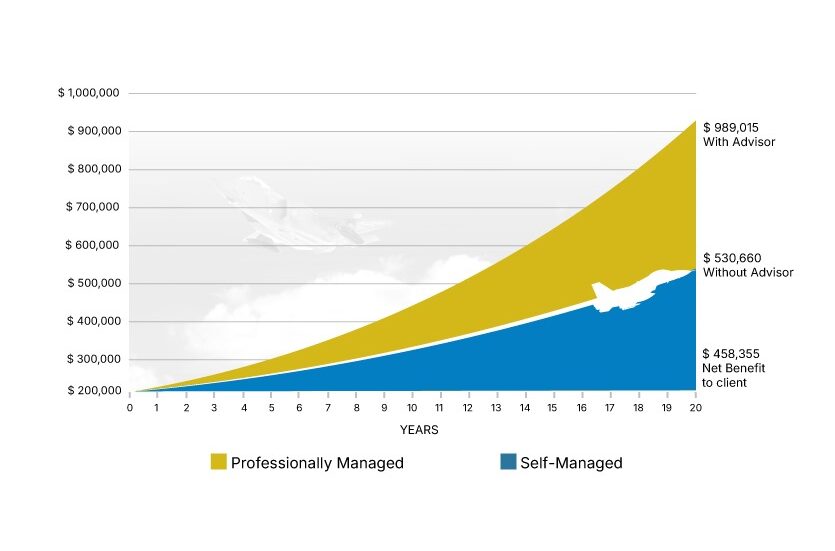

Lastly, according to a Vanguard study of 40,000 participants, managed accounts have a notable effect on returns due to increased equity exposure and savings rates, as well as a reduction in portfolio risk levels and costs. Of the participants surveyed, it was reported that:

- 60% increased their projected 10-year retirement wealth by an average of 30%.

- 30% earned value through a reduction in portfolio risk.

- 1/3 chose to increase their savings rate by an average of 3%.

- 60% saw a reduction in average fund fees.

- Expense ratios were reduced by an average of 0.06%.

*According to Vanguard’s study based on their Alpha framework. Putting a value on your value: Quantifying Vanguard Advisor’s Alpha, Vanguard Research, 2016.

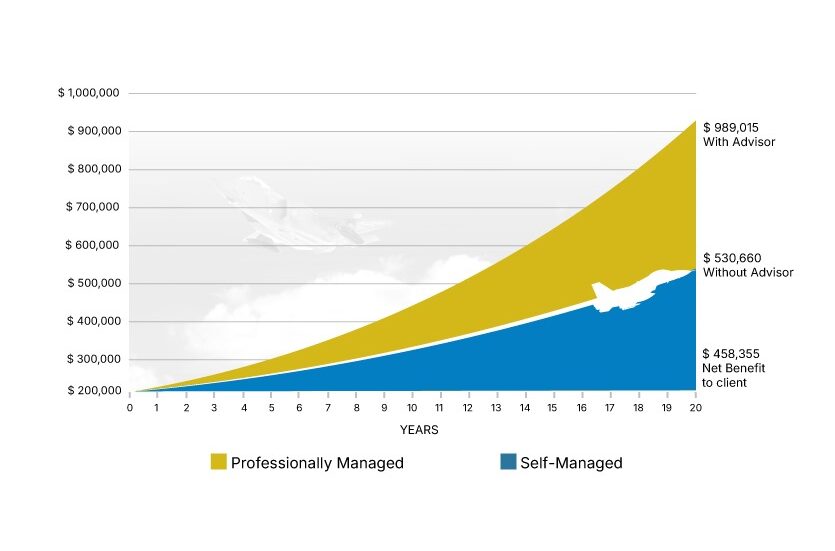

Professionally managed 401k’s outperform self-managed by 3.32% annually, net of fees

For a 45-year-old participant that seeks the help of a financial professional it could translate to 79% more wealth at age 65.3.

– AON HEWITT

*Hypothetical example for illustrative purposes.

*According to Russell Investments annual study. Why Advisors Have Never Been So Valuable, 2017

Value of an Advisor Study.

Professionally managed 401k’s outperform self-managed by 3.32% annually, net of fees

For a 45-year-old participant that seeks the help of a financial professional it could translate to 79% more wealth at age 65.3.

– AON HEWITT

*Hypothetical example for illustrative purposes.

*According to Russell Investments annual study. Why Advisors Have Never Been So Valuable, 2017

Value of an Advisor Study.

Diverse Options and

Prime Growth Potential.

The SDBA gives you access to work with a financial advisor and access a much wider range of investment options, offering greater diversification opportunities and the potential for higher returns.

We want to provide you a very inexpensive but very valuable solution to help you change your investment future in your Lockheed Martin retirement account. Let us show you how we may help you earn an extra 1-3% per year.

*Stewardship Advisory Group does not offer legal or tax advice. Please consult the appropriate professional.

*Rebalancing/Reallocating can entail transaction costs and tax consequences that should be considered when determining a rebalancing/reallocation

Diverse Options and

Prime Growth Potential.

The SDBA gives you access to work with a financial advisor and access a much wider range of investment options, offering greater diversification opportunities and the potential for higher returns. We want to provide you a very inexpensive but very valuable solution to help you change your investment future in your Lockheed Martin retirement account. Let us show you how we may help you earn an extra 1-3% per year.

*Stewardship Advisory Group does not offer legal or tax advice. Please consult the appropriate professional.

*Rebalancing/Reallocating can entail transaction costs and tax consequences that should be considered when determining a rebalancing/reallocation

Our firm has assisted executives and engineers who have worked at Lockheed Martin for decades. Our experience working with people just like you means:

Professional 401(k) Management:

We can assist you in taking advantage of the two “secret weapons” that are available to you in your 401(k) plan. Schedule a Call or Check out our Lockheed Martin Retirement Guide to learn more!

Pension Maximization:

Take control of your pension and help make sure that you are going to be choosing the best payout option to assist with retirement income for you and make sure that this is income is protected for your family.

Employee Benefits:

Navigating your employee benefits can be confusing, but it doesn’t have to be! We can assist you with determining the right benefits for you during your enrollment period.

Retirement Planning:

Build a Retirement Plan specifically engineered to your goals and gain clarity, confidence, control, and contentment in your future. Learn more abot our process here.